Understanding ZG Stock: Insights, Trends, And Investment Opportunities

ZG stock has gained significant attention in the financial markets, attracting both seasoned investors and newcomers alike. This article will explore what ZG stock represents, its performance metrics, and the factors influencing its valuation. By the end of this guide, you will have a clear understanding of ZG stock and whether it fits your investment strategy.

In recent years, the stock market has seen fluctuations that can create both opportunities and challenges for investors. ZG stock, associated with a prominent company in its sector, has experienced its share of ups and downs. Understanding the underlying elements of ZG stock is crucial for anyone looking to make informed investment decisions.

This article aims to provide comprehensive insights into ZG stock, covering its historical performance, market trends, expert analyses, and future projections. Whether you’re considering investing in ZG stock or simply want to expand your knowledge of the stock market, this article serves as your ultimate guide.

Table of Contents

- What is ZG Stock?

- Historical Performance of ZG Stock

- Current Market Trends Affecting ZG Stock

- Financial Analysis of ZG Stock

- Investor Sentiment around ZG Stock

- Future Outlook for ZG Stock

- Risks and Considerations

- Conclusion

What is ZG Stock?

ZG stock refers to the shares of a company known for its innovative approach in its industry. The company has positioned itself as a leader in its sector, focusing on development and growth strategies that resonate well with consumers and investors alike. ZG stock is traded on major exchanges, making it accessible for various types of investors.

Company Overview

Founded in [Year], the company has continually adapted to market changes, allowing it to thrive amidst competition. Its core business revolves around [describe core business], which has proven to be a lucrative venture in recent years.

Data and Personal Information

| Company Name | [Company Name] |

|---|---|

| Ticker Symbol | ZG |

| Industry | [Industry Type] |

| Founded | [Year] |

| CEO | [CEO Name] |

Historical Performance of ZG Stock

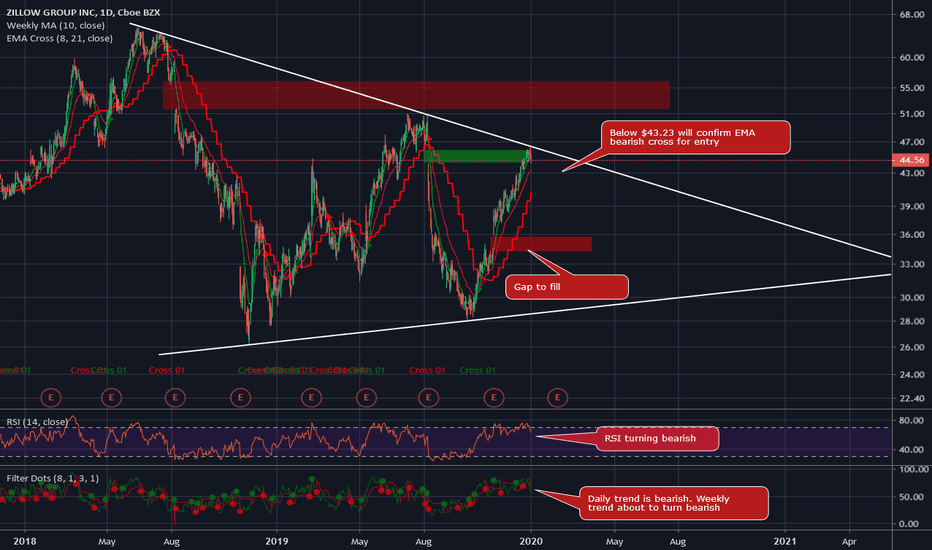

The historical performance of ZG stock showcases its volatility and growth potential. Over the past five years, ZG stock has seen a [brief description of growth or decline], which can be attributed to several market factors.

Price History and Trends

Analyzing the price history of ZG stock reveals critical insights into its market behavior:

- In [Year], ZG stock reached an all-time high of [Price].

- The stock faced a significant drop in [Year] due to [reason].

- Since then, recovery trends have shown [describe recovery].

Current Market Trends Affecting ZG Stock

As of [current date], the market trends surrounding ZG stock are influenced by various economic indicators and industry developments. Understanding these trends is essential for predicting future performance.

Economic Indicators

Key economic indicators that may impact ZG stock include:

- Interest Rates: Changes in interest rates can affect borrowing costs and consumer spending.

- Inflation Rates: Rising inflation may influence consumer behavior and operational costs.

- Unemployment Rates: Higher unemployment can lead to decreased demand for products and services.

Industry Developments

Recent developments within the industry also play a crucial role in shaping ZG stock's performance. Noteworthy trends include:

- Technological Advancements: The company’s investment in technology may enhance operational efficiency.

- Regulatory Changes: New regulations can either benefit or hinder company operations.

- Market Competition: The emergence of new competitors may challenge ZG's market share.

Financial Analysis of ZG Stock

Conducting a financial analysis of ZG stock involves examining various metrics that indicate the company's health and profitability. Key financial indicators include:

Revenue and Earnings Growth

The revenue and earnings growth of ZG stock provide insight into its operational success:

- Revenue growth has been recorded at [percentage]% over the last fiscal year.

- Earnings per share (EPS) has shown an upward trend, reaching [EPS value].

Valuation Metrics

To assess the valuation of ZG stock, investors often consider the following metrics:

- Price-to-Earnings (P/E) Ratio: Currently at [P/E value], which indicates [explanation].

- Price-to-Book (P/B) Ratio: At [P/B value], suggesting [explanation].

Investor Sentiment around ZG Stock

Understanding investor sentiment is critical in predicting market movements. Current sentiment around ZG stock can be gauged through various channels:

Analyst Ratings

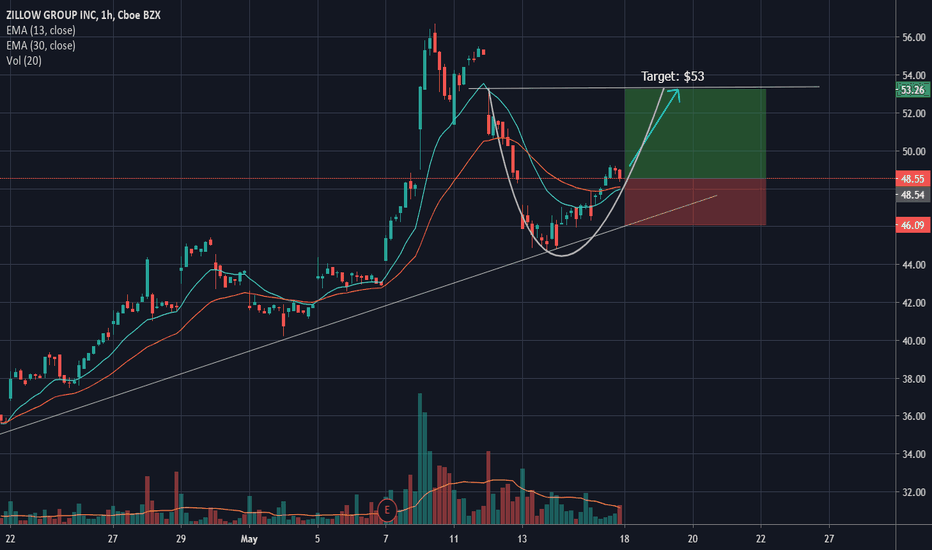

Market analysts have provided their ratings and forecasts for ZG stock:

- [Analyst Name] rates ZG stock as a [buy/sell/hold] with a target price of [target price].

- Several analysts highlight [mention any specific trends or recommendations].

Social Media and News Sentiment

Monitoring social media and news outlets can give insights into public perception:

- Social media discussions around ZG stock have been [positive/negative], indicating [explanation].

- Recent news articles have focused on [mention any relevant news].

Future Outlook for ZG Stock

The future outlook for ZG stock appears promising, provided certain conditions are met. Analysts predict that ZG stock could experience growth due to [reasons for optimism].

Forecasts and Predictions

Analysts’ forecasts suggest that if trends continue, ZG stock could reach [price projection] by [year].

Potential Catalysts for Growth

Several potential catalysts may drive ZG stock's growth:

- New product launches in [year].

- Expansion into [new markets or sectors].

- Strategic partnerships with [company names].

Risks and Considerations

Investing in ZG stock does come with its share of risks. Key risks to consider include:

Market Volatility

The stock market is inherently volatile, and ZG stock may experience fluctuations that could impact investment returns.

Company-Specific Risks

Potential risks specific to the company include:

- Operational challenges in [specific areas].

- Increased competition from [mention competitors].

Conclusion

In summary, ZG stock presents a compelling opportunity for investors looking to diversify their portfolios. With its proven track record, innovative strategies, and a positive market outlook, ZG stock could be a valuable addition. However, it is essential to consider market conditions and risks before making any investment decisions.

If you found this article helpful, please leave a comment below or share it with others who may be interested in learning more about ZG stock. For further insights, feel free to explore our other articles on investment strategies and market analysis.

Thank you for reading, and we invite you to return for more informative content on stock investments and market trends!

Manchester City Vs Manchester United: The Rivalry Of The Century

Understanding REIT Stocks: A Comprehensive Guide For Investors

Understanding The Importance Of Ioo In Modern Technology