Understanding RDFN Stock: A Comprehensive Guide To Redfin Corporation's Market Performance

RDFN stock represents the shares of Redfin Corporation, a technology-powered real estate brokerage that has been transforming the way people buy and sell homes. As the real estate market continues to evolve, investors are increasingly looking at innovative companies like Redfin to understand potential growth and investment opportunities. This article delves into the fundamentals of RDFN stock, its historical performance, and the factors influencing its market trajectory.

In the wake of technological advancements and changing consumer behaviors, companies that leverage technology in traditional industries like real estate are gaining attention. Redfin has positioned itself as a leader in this space, offering a unique blend of technology and real estate services. This article will explore RDFN stock's performance, market trends, and expert opinions to provide a thorough understanding of its investment potential.

Whether you are a seasoned investor or a newcomer to the stock market, understanding RDFN stock can help you make informed decisions. We will cover various aspects, including the company's history, financial performance, market position, and future outlook, equipping you with the knowledge needed to evaluate this exciting investment opportunity.

Table of Contents

- 1. Company Overview

- 2. Historical Performance of RDFN Stock

- 3. Key Financial Metrics

- 4. Market Position and Competitors

- 5. Factors Influencing RDFN Stock

- 6. Future Outlook for Redfin Corporation

- 7. Expert Opinions and Analyst Ratings

- 8. Conclusion and Call to Action

1. Company Overview

Redfin Corporation was founded in 2004 by David Eraker, Michael Dougherty, and David Selinger. The company operates as a full-service real estate brokerage and offers various services, including buying and selling homes, mortgage, title services, and more. Redfin's unique selling proposition lies in its technology-driven approach, which allows for a more efficient and customer-friendly real estate experience.

1.1 Redfin's Business Model

Redfin operates on a hybrid model that combines traditional real estate brokerage services with technology solutions. This model enables the company to offer lower commission rates and better customer service. Key aspects of Redfin's business model include:

- Innovative technology platform for home searches and purchases

- Lower commission fees compared to traditional brokerages

- Direct access to real estate agents and market data

1.2 Redfin's Mission and Vision

Redfin's mission is to reinvent real estate in the consumer's favor by combining technology and human expertise. The company's vision is to create a world where home buying and selling is seamless, transparent, and accessible to all.

2. Historical Performance of RDFN Stock

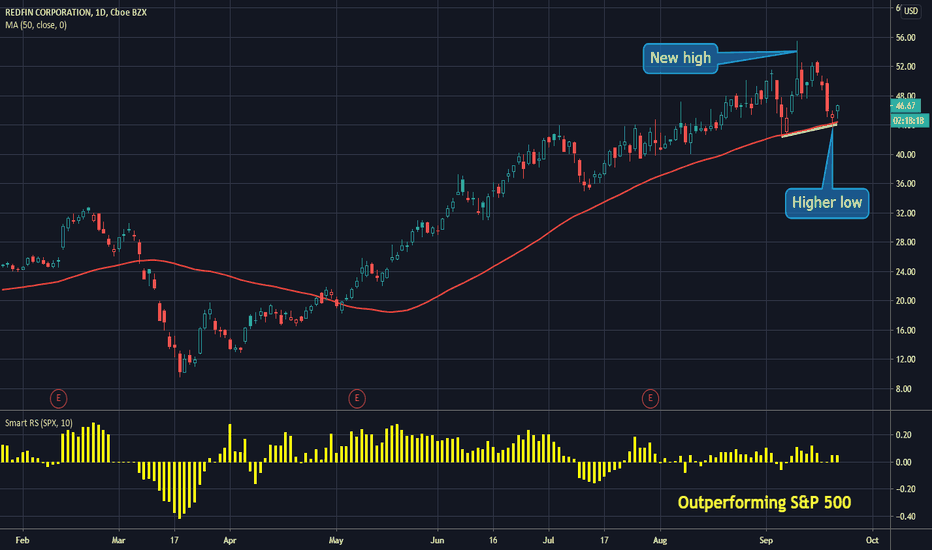

RDFN stock was publicly listed in July 2017, and since then, it has experienced significant volatility, reflecting broader trends in the real estate market and the tech industry. Understanding the historical performance of RDFN stock can provide valuable insights into its potential future trajectory.

2.1 Initial Public Offering (IPO)

Redfin went public at an initial share price of $15. The stock experienced a strong debut, reflecting positive investor sentiment towards the company's innovative approach to real estate.

2.2 Stock Price Trends

Since its IPO, RDFN stock has seen fluctuations influenced by various market conditions and company performance metrics. Notable points include:

- Rapid growth in the first year, reaching over $25 per share

- Market corrections leading to price declines during economic downturns

- Recent recovery trends driven by increased demand for real estate services

3. Key Financial Metrics

To assess RDFN stock's performance effectively, it is crucial to analyze key financial metrics. These metrics provide insights into the company's profitability, growth potential, and overall financial health.

3.1 Revenue Growth

Redfin has demonstrated consistent revenue growth, reflecting its increasing market share and expanding service offerings. Key figures include:

- 2020 Revenue: $869 million

- 2021 Revenue: $1.3 billion (estimated)

- Year-over-year growth rate of over 50%

3.2 Profitability Metrics

While Redfin has seen significant revenue growth, profitability remains a focus for investors. Notable metrics include:

- Gross profit margin: Approximately 20%

- Net losses recorded in recent years due to reinvestment in technology and marketing

4. Market Position and Competitors

Redfin operates in a competitive market, facing challenges from both traditional real estate brokerages and emerging tech-driven platforms. Understanding its market position is essential for evaluating RDFN stock.

4.1 Comparison with Competitors

Redfin competes with several key players in the real estate market, including:

- Zillow (ZG)

- Realtor.com

- Opendoor Technologies (OPEN)

Each competitor has its unique strengths and weaknesses, influencing consumer preferences and market share.

4.2 Market Share Insights

Redfin has successfully captured a significant portion of the online real estate market, bolstered by its innovative technology and customer-centric approach. Current estimates suggest that Redfin holds approximately 1.5% of the U.S. residential real estate market.

5. Factors Influencing RDFN Stock

Several factors can impact the performance of RDFN stock, including economic trends, consumer behavior, and regulatory changes. Understanding these influences can help investors make informed decisions.

5.1 Economic Trends

The real estate market is closely tied to broader economic conditions. Factors such as interest rates, employment rates, and consumer confidence play a significant role in shaping demand for real estate services.

5.2 Consumer Behavior Shifts

Changes in consumer preferences, particularly in the wake of the COVID-19 pandemic, have influenced the demand for online real estate services. Increased reliance on technology for home searches and virtual tours has played to Redfin's strengths.

6. Future Outlook for Redfin Corporation

As the real estate landscape continues to evolve, Redfin's future outlook appears promising. Several trends indicate potential growth opportunities for the company and RDFN stock.

6.1 Expansion Plans

Redfin has plans to expand its services into new markets and enhance its technology platform, which could drive additional revenue growth. Key initiatives include:

- Entering new geographical markets

- Enhancing mobile app features for a better user experience

- Investing in data analytics to improve service offerings

6.2 Market Predictions

Analysts predict continued growth in the online real estate market, with estimates suggesting a compound annual growth rate (CAGR) of over 10% in the coming years. Redfin's innovative approach positions it well to capitalize on these trends.

7. Expert Opinions and Analyst Ratings

Expert opinions and analyst ratings provide valuable insights into the potential performance of RDFN stock. Understanding the perspectives of financial analysts can help investors gauge market sentiment.

7.1 Analyst Ratings

Many analysts have a positive outlook on RDFN stock, citing its strong growth potential and innovative business model. Recent ratings include:

- Buy ratings from major financial institutions

- Target price estimates suggesting potential upside of 20% from current levels

7.2 Expert Insights

Industry experts emphasize the importance of monitoring market trends and Redfin's strategic initiatives. Their analyses highlight the potential risks associated with market volatility but remain optimistic about the company's long-term growth prospects.

8. Conclusion and Call to Action

In summary, RDFN stock presents an intriguing investment opportunity in the evolving real estate market. With its innovative technology, strong revenue growth, and positive market outlook, Redfin Corporation is well-positioned for future success. As with any investment, it is essential to conduct thorough research and consider market conditions before making decisions.

We encourage readers to share their thoughts in the

9/11 Dark Humor Jokes: Understanding The Boundaries Of Comedy

Exploring Yahoo.com: A Comprehensive Guide To One Of The Internet's Oldest Portals

Yahoo.com Email Login: A Comprehensive Guide To Accessing Your Account