Understanding ES Futures: A Comprehensive Guide

ES Futures, also known as E-mini S&P 500 Futures, are a popular financial instrument in the world of trading and investing. These contracts represent a portion of the S&P 500 index, allowing traders to speculate on the future direction of this major U.S. stock market index. As interest in futures trading grows, it is crucial to understand the dynamics of ES Futures, how they work, and the strategies that can be employed for successful trading.

This article aims to provide an in-depth overview of ES Futures, making it accessible for both novice and seasoned traders. We'll delve into the mechanics of these futures contracts, their benefits and risks, trading strategies, and an analysis of market trends. By the end of this guide, you will have a solid foundation to navigate the complexities of ES Futures trading.

Whether you are looking to hedge against market volatility or to capitalize on price movements, understanding ES Futures is essential for modern investors. Let's embark on this journey through the world of E-mini S&P 500 Futures and explore how you can leverage this financial instrument for your investment portfolio.

Table of Contents

- What Are ES Futures?

- Biography of ES Futures

- How Do ES Futures Work?

- Benefits of Trading ES Futures

- Risks Associated with ES Futures

- Effective Trading Strategies for ES Futures

- Current Market Trends and Analysis

- Conclusion

What Are ES Futures?

ES Futures, or E-mini S&P 500 Futures, are derivative contracts that allow traders to buy or sell the future value of the S&P 500 index. The E-mini contract is one-fifth the size of a standard S&P 500 futures contract, making it more accessible to individual traders. The ES Futures are traded on the Chicago Mercantile Exchange (CME), providing a platform for hedging and speculation.

The value of the ES Futures contract is derived from the S&P 500 index, which comprises 500 of the largest publicly traded companies in the U.S. This index is a benchmark for the overall performance of the U.S. stock market, making ES Futures a popular choice for traders looking to gain exposure to the equity market without purchasing individual stocks.

Key Features of ES Futures

- Contract Size: Each ES Futures contract represents $50 times the S&P 500 index.

- Trading Hours: ES Futures can be traded nearly 24 hours a day, providing flexibility for traders around the globe.

- Margin Requirements: Traders can control a larger position with a relatively small amount of capital due to margin trading.

- Liquidity: ES Futures are one of the most liquid futures contracts, making it easier to enter and exit positions.

Biography of ES Futures

| Attribute | Details |

|---|---|

| Introduced | 1997 |

| Exchange | Chicago Mercantile Exchange (CME) |

| Contract Size | $50 x S&P 500 Index |

| Tick Size | 0.25 points ($12.50 per contract) |

| Trading Hours | Nearly 24 hours, Sunday to Friday |

How Do ES Futures Work?

ES Futures work by allowing traders to enter into a contract to buy or sell the S&P 500 index at a specified price on a future date. The price is determined by market forces and reflects the expected future value of the index. Here's how the process works:

1. Opening a Position

To trade ES Futures, you need to open a brokerage account that supports futures trading. Once your account is funded, you can place an order to buy or sell an ES Futures contract. The contract price will fluctuate based on market conditions.

2. Margin and Leverage

Futures trading typically involves margin, which means you can control a larger position than your initial investment. The margin requirement for ES Futures is usually a small percentage of the contract's total value, allowing traders to leverage their capital.

3. Closing a Position

Traders can close their positions before the contract expiration date by placing an offsetting order. This can be done to take profits or limit losses. Alternatively, ES Futures contracts can be held until expiration, at which point the contract will be settled in cash based on the index value.

Benefits of Trading ES Futures

There are several advantages to trading ES Futures, making them a preferred choice for many traders:

- High Liquidity: The E-mini S&P 500 Futures market is one of the most liquid, allowing for quick entry and exit from trades.

- Cost-Effective: With lower margin requirements compared to other investment options, traders can access the market with less capital.

- Diversification: ES Futures provide exposure to a broad market index, which can help diversify an investment portfolio.

- Hedging Opportunities: Investors can use ES Futures to hedge against potential losses in their stock portfolios.

- Accessibility: The E-mini contract is designed for individual traders, making it easier for retail investors to participate.

Risks Associated with ES Futures

While trading ES Futures offers numerous benefits, it is essential to be aware of the risks involved:

1. Market Volatility

The futures market can be highly volatile, leading to significant price swings. Traders must be prepared for rapid changes in their positions.

2. Leverage Risks

While leverage can amplify profits, it can also magnify losses. Traders should use proper risk management strategies to mitigate potential losses.

3. Complexity

Futures trading can be complex, requiring a deep understanding of market dynamics and trading strategies. Beginners may find it challenging without proper education and experience.

Effective Trading Strategies for ES Futures

To succeed in trading ES Futures, traders can employ various strategies tailored to their risk tolerance and market outlook:

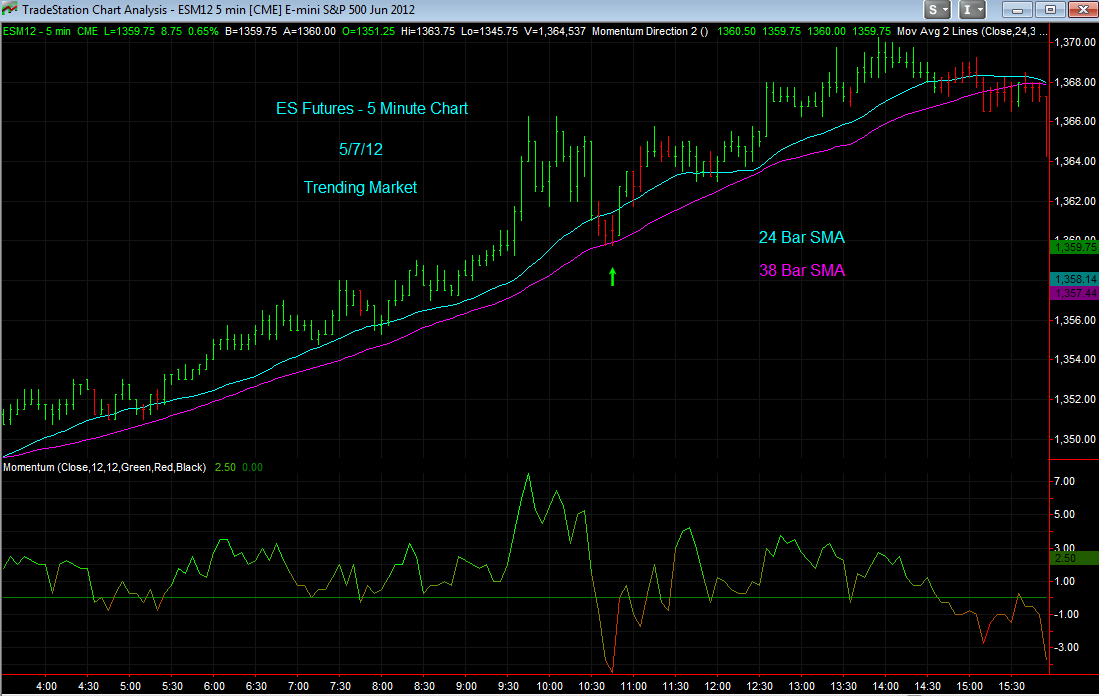

1. Trend Following

This strategy involves identifying and following market trends. Traders look for patterns in price movements and enter positions in the direction of the prevailing trend.

2. Range Trading

Range trading focuses on identifying support and resistance levels. Traders buy when prices are near support and sell when they approach resistance.

3. News-Based Trading

Market news and economic reports can significantly impact the S&P 500 index. Traders can capitalize on price movements resulting from major news events.

4. Automated Trading

Utilizing trading algorithms and bots can help in executing trades based on pre-defined criteria, enhancing efficiency and speed in the trading process.

Current Market Trends and Analysis

Monitoring market trends is vital for successful trading in ES Futures. As of the latest data, the S&P 500 index has shown resilience in the face of economic challenges, with a focus on technology and consumer discretionary sectors driving growth. Traders should stay informed about macroeconomic indicators, interest rates, and geopolitical events that could influence market sentiment.

Conclusion

In conclusion, ES Futures provide an exciting avenue for traders looking to engage with the U.S. stock market. By understanding how these contracts work, the benefits and risks associated with trading them, and effective strategies, you can enhance your trading experience. As with any investment, it’s crucial to conduct thorough research and develop a solid trading plan.

If you found this article helpful, please leave a comment, share it with others, or explore more articles on our site to deepen your understanding of futures trading.

Penutup

Thank you for taking the time to read this comprehensive guide on ES Futures. We hope you found valuable insights that will aid you in your trading journey

Bruce Willis Height And Weight: A Comprehensive Look At The Action Star

Is Mbappe The Fastest Player In The World?

The Concept Of Celibate: Understanding Its Meaning And Implications