VWO Stock: An In-Depth Analysis Of Vanguard FTSE Emerging Markets ETF

VWO stock is a popular investment option for those looking to gain exposure to emerging markets. In this article, we will explore the various aspects of VWO stock, its performance, and the factors influencing its market presence. As the world becomes increasingly interconnected, investors are keen to diversify their portfolios, and VWO provides an avenue to invest in emerging economies. With the growing interest in sustainable investing, understanding VWO's position in the market is crucial for both novice and seasoned investors.

In this comprehensive guide, we will dissect VWO stock, examining its historical performance, key holdings, and the economic factors that impact its valuation. We will also delve into the benefits and risks associated with investing in VWO and offer insights into how it fits into a broader investment strategy. By the end of this article, you will have a clearer understanding of VWO stock and whether it aligns with your investment goals.

Whether you are new to investing or an experienced trader, this article aims to provide valuable insights into VWO stock. Utilizing reliable data and expert opinions, we will ensure that you are well-equipped to make informed investment decisions. So, let's begin our exploration of VWO stock and uncover what makes it a noteworthy option in the world of emerging markets.

Table of Contents

- What is VWO?

- VWO Stock Biography

- Performance Analysis of VWO Stock

- Key Holdings in VWO

- Economic Factors Influencing VWO

- Benefits of Investing in VWO Stock

- Risks Associated with VWO Stock

- Incorporating VWO into Your Investment Strategy

- Conclusion

What is VWO?

VWO, or Vanguard FTSE Emerging Markets ETF, is an exchange-traded fund that offers investors exposure to stocks in emerging market countries. Launched in 2005, VWO has become one of the largest and most popular ETFs for gaining access to emerging economies. The fund tracks the performance of the FTSE Emerging Markets All Cap China A Inclusion Index, which includes companies from various sectors and regions.

Key Features of VWO

- Expense Ratio: VWO boasts a low expense ratio, making it an attractive investment option for cost-conscious investors.

- Diversification: VWO provides exposure to a wide range of emerging market countries, reducing the risk associated with investing in a single country or sector.

- Liquidity: As a highly traded ETF, VWO offers investors the ability to buy and sell shares easily, enhancing market accessibility.

VWO Stock Biography

| Detail | Information |

|---|---|

| Fund Manager | Vanguard Group |

| Launch Date | March 2005 |

| Index Tracked | FTSE Emerging Markets All Cap China A Inclusion Index |

| Expense Ratio | 0.10% |

| Assets Under Management | Approximately $50 billion (as of 2023) |

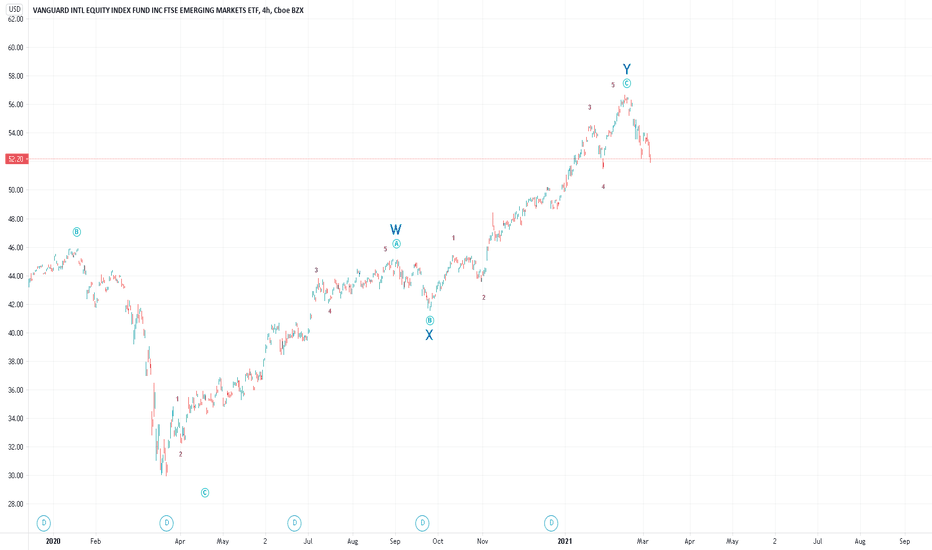

Performance Analysis of VWO Stock

The performance of VWO stock is influenced by various economic and geopolitical factors. Over the years, VWO has shown resilience and growth, but it is essential to analyze its performance metrics to understand its investment viability.

Historical Performance

VWO's historical performance can be assessed through its annual returns, which have fluctuated based on global economic conditions. For instance:

- In 2020, VWO experienced a significant rebound after the COVID-19 market crash, achieving a return of over 10%.

- In 2021, the fund continued its upward trajectory, primarily driven by recovery in emerging markets, recording returns exceeding 20%.

- However, in 2022, VWO faced challenges due to inflationary pressures and geopolitical tensions, resulting in a decline of approximately 5%.

Performance Metrics

Investors should consider various performance metrics when evaluating VWO stock:

- Annualized Return: The annualized return provides a clear picture of how VWO has performed over multiple years.

- Volatility: Understanding the volatility of VWO is crucial for assessing risk tolerance.

- Correlation with Global Markets: Analyzing how VWO correlates with major global indices can help investors understand its behavior in different market conditions.

Key Holdings in VWO

VWO's portfolio is diversified across various sectors and countries, providing exposure to some of the largest companies in emerging markets. The top holdings typically include:

- Taiwan Semiconductor Manufacturing Co. (TSMC)

- Alibaba Group Holding Ltd.

- Tencent Holdings Ltd.

- Reliance Industries Ltd.

- Vale S.A.

These companies represent significant portions of VWO's total assets, and their performance can greatly influence the fund's overall returns.

Economic Factors Influencing VWO

Several economic factors impact the performance of VWO stock, including:

- Global Economic Growth: Emerging markets often outperform during periods of global economic expansion.

- Currency Fluctuations: Changes in currency values can affect the returns of VWO as it invests in foreign assets.

- Political Stability: Political events in emerging market countries can create volatility in VWO's performance.

Market Trends

Understanding current market trends is essential for assessing VWO's potential. Recent trends include:

- Increased focus on sustainable investing, which may benefit companies in VWO that prioritize ESG (Environmental, Social, and Governance) criteria.

- Technological advancements in emerging markets, boosting sectors such as technology and renewable energy.

Benefits of Investing in VWO Stock

Investing in VWO stock offers various benefits:

- Diversification: VWO allows investors to diversify their portfolios by gaining exposure to multiple emerging markets.

- Access to Growth: Emerging markets often exhibit higher growth potential compared to developed markets.

- Cost-Effectiveness: With a low expense ratio, VWO provides a cost-effective way to invest in emerging markets.

Risks Associated with VWO Stock

While VWO presents numerous opportunities, it also carries inherent risks:

- Market Volatility: Emerging markets can be subject to significant volatility, impacting VWO's performance.

- Economic Conditions: Changes in global economic conditions can affect the growth trajectories of the underlying assets in VWO.

- Political Risks: Political instability in emerging markets can lead to sudden market changes and affect investment returns.

Incorporating VWO into Your Investment Strategy

To effectively incorporate VWO into your investment strategy, consider the following tips:

- Risk Tolerance: Assess your risk tolerance to determine how much exposure to VWO fits within your portfolio.

- Diversification: Use VWO to diversify your investments across different asset classes and geographic regions.

- Regular Monitoring: Keep an eye on VWO's performance and the economic factors influencing its valuation.

Conclusion

In summary, VWO stock represents a compelling investment opportunity for those looking to gain exposure to emerging markets. With its strong historical performance, diversified holdings, and potential for growth, it can be a valuable addition to an investment portfolio. However, investors must also consider the associated risks and market dynamics before making investment decisions.

We encourage you to leave comments, share this article, or explore other insights on our site. Your engagement helps us provide valuable content

Understanding HP Stock: A Comprehensive Guide For Investors

Ariana Grande 2024: A Look Into The Future Of The Pop Icon

Top Artificial Intelligence Stocks To Buy In 2023