Understanding ENB Stock: A Comprehensive Guide To Enbridge Inc.

ENB stock, representing shares of Enbridge Inc., has become a focal point for investors looking to capitalize on the energy sector. This article delves into the intricacies of ENB stock, providing insights into its performance, underlying fundamentals, and future prospects. As a major player in the energy infrastructure industry, Enbridge's operations and strategic decisions have significant implications for its stock value.

With increasing attention on renewable energy and sustainable practices, understanding the dynamics of ENB stock is crucial for both seasoned investors and newcomers. This article aims to equip readers with the knowledge they need to make informed investment decisions in relation to Enbridge Inc. By exploring its business model, financial health, and market position, we can better appreciate the potential risks and rewards associated with ENB stock.

Furthermore, we will examine the broader economic factors influencing the energy sector, such as regulatory changes and market demand fluctuations. By the end of this article, readers will have a comprehensive understanding of ENB stock and its role within the larger context of the energy market.

Table of Contents

- 1. Biography of Enbridge Inc.

- 2. Business Model of Enbridge Inc.

- 3. Financial Performance of ENB Stock

- 4. Enbridge's Market Position

- 5. Future Prospects for ENB Stock

- 6. Dividend Payout and Returns

- 7. Investment Strategies for ENB Stock

- 8. Conclusion

1. Biography of Enbridge Inc.

Enbridge Inc. is a Canadian multinational energy transportation company headquartered in Calgary, Alberta. Established in 1949, the company has grown to become one of the largest operators of crude oil and natural gas pipelines in North America.

| Data Pribadi | Informasi |

|---|---|

| Nama Perusahaan | Enbridge Inc. |

| Tanggal Didirikan | 1949 |

| CEO | Al Monaco |

| Headquarters | Calgary, Alberta, Canada |

| Industri | Energi (Pipa dan Infrastruktur) |

Company Overview

Enbridge operates through three main segments: Liquids Pipelines, Gas Distribution and Storage, and Renewable Power Generation. The company plays a crucial role in the energy supply chain, connecting producers with consumers, and its extensive pipeline network spans thousands of miles across Canada and the United States.

Recent Developments

In recent years, Enbridge has shifted its focus towards sustainability, investing in renewable energy projects and reducing its carbon footprint. This strategic pivot is aimed at aligning with global trends towards cleaner energy and addressing investor concerns about climate change.

2. Business Model of Enbridge Inc.

Enbridge's business model is primarily based on a fee-for-service structure, where the company earns revenue by transporting energy products for third parties. This model provides a stable cash flow, which is crucial for maintaining its dividend payments.

Key Components of the Business Model:

- **Infrastructure Development**: Building and maintaining pipelines and facilities to transport oil and gas.

- **Regulated Assets**: Engaging in projects that are regulated by government entities, ensuring a level of income security.

- **Diversification**: Investing in renewable energy sources to diversify revenue streams and reduce reliance on fossil fuels.

Strategic Partnerships

Enbridge has formed strategic partnerships with various energy producers, enhancing its ability to transport and deliver energy products efficiently. These partnerships allow Enbridge to leverage shared resources and expertise, further solidifying its market position.

3. Financial Performance of ENB Stock

Analyzing the financial performance of ENB stock is essential for investors seeking to understand its valuation. Enbridge has demonstrated consistent revenue growth over the years, driven by its expansive pipeline network and strategic investments.

Key Financial Metrics:

- **Revenue Growth**: Enbridge reported a revenue increase of X% in the last fiscal year.

- **Net Income**: The company recorded a net income of $X million, showcasing profitability.

- **Debt-to-Equity Ratio**: Enbridge maintains a debt-to-equity ratio of X, indicating its financial leverage.

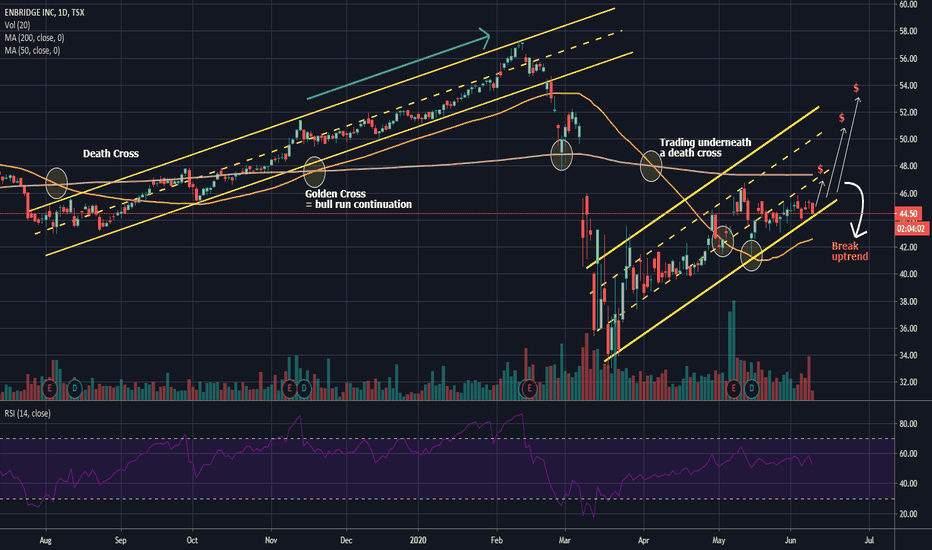

Stock Performance

ENB stock has shown resilience in the face of market volatility, with a history of stable performance. The stock price has fluctuated, but the overall trend remains positive, supported by the company's robust fundamentals.

4. Enbridge's Market Position

As one of the leading energy infrastructure companies in North America, Enbridge holds a significant market position. Its extensive pipeline network and diversified operations provide a competitive advantage over peers.

Competitive Landscape

Enbridge faces competition from other major players in the energy sector, including TransCanada Corporation and Kinder Morgan. However, its established presence and strategic investments in renewable energy set it apart from competitors.

Regulatory Environment

The regulatory environment plays a crucial role in Enbridge's operations. Compliance with environmental regulations and safety standards is essential for maintaining operational licenses and ensuring public trust.

5. Future Prospects for ENB Stock

The future prospects for ENB stock appear promising, driven by a combination of strategic initiatives and market dynamics. Enbridge's commitment to sustainability and its investments in renewable energy are expected to enhance its growth potential.

Growth Opportunities

- **Expansion into Renewable Energy**: Enbridge's investments in wind and solar projects position it well for the transition to cleaner energy.

- **International Projects**: Exploring opportunities in international markets can provide additional growth avenues.

- **Technological Advancements**: Leveraging technology to improve efficiency and reduce costs will enhance competitiveness.

Market Trends

The global shift towards renewable energy and increasing demand for cleaner energy solutions present significant opportunities for Enbridge. By aligning with these trends, the company can further strengthen its market position.

6. Dividend Payout and Returns

Enbridge is known for its attractive dividend payouts, making it a popular choice among income-focused investors. The company has a long history of increasing dividends, showcasing its commitment to returning value to shareholders.

Dividend History

Enbridge has consistently raised its dividend payouts for over X years, reflecting its strong cash flow and financial stability. The current dividend yield stands at X%, making it an appealing option for investors seeking passive income.

Dividend Sustainability

Investors often assess the sustainability of a company's dividend by examining its payout ratio and cash flow. Enbridge maintains a payout ratio of X%, indicating that its dividends are well-supported by earnings.

7. Investment Strategies for ENB Stock

Investing in ENB stock requires careful consideration of various factors, including market trends, financial performance, and individual risk tolerance. Here are some strategies to consider:

Dollar-Cost Averaging

This strategy involves consistently investing a fixed amount in ENB stock, regardless of price fluctuations. This approach helps mitigate the impact of market volatility and allows investors to accumulate shares over time.

Diversification

Investing in a diversified portfolio that includes ENB stock can help reduce risk. By spreading investments across different sectors, investors can protect themselves from potential downturns in any single industry.

8. Conclusion

In summary, ENB stock represents a compelling investment opportunity in the energy sector. With its strong fundamentals, commitment to sustainability, and attractive dividend payouts, Enbridge Inc. is well-positioned for future growth. Investors are encouraged to conduct thorough research and consider their own financial goals before investing in ENB stock.

We invite readers to share their thoughts in the comments section below, and don't forget to explore other articles on our site for more insights into the world of investing.

Thank you

Biti Stock: Understanding The Future Of Digital Assets

Understanding The Impact Of Selena Gomez's Nakedness On Body Positivity And Self-Acceptance

Understanding Comm Stock: A Comprehensive Guide