Understanding NYSE KO: A Comprehensive Guide To The Coca-Cola Company's Stock

When it comes to investing in the stock market, understanding key players like NYSE KO is crucial. NYSE KO, which represents The Coca-Cola Company, is one of the most recognized and traded stocks on the New York Stock Exchange. As an investor, knowing about its performance, historical data, and market strategies can significantly impact your financial decisions.

In this article, we will delve deep into the intricacies of NYSE KO, exploring its history, current performance, and future outlook. We will also provide insights into why it’s essential to monitor this stock, especially for those interested in the beverage industry. The Coca-Cola Company has been a staple in the market, making it a popular choice among investors.

By the end of this comprehensive guide, you will have a better understanding of NYSE KO and its significance in the stock market. Whether you are a seasoned investor or just starting, this information will equip you with the necessary knowledge to make informed decisions regarding your investments.

Table of Contents

- 1. Overview of NYSE KO

- 2. Historical Performance of Coca-Cola Stock

- 3. Key Financial Metrics of NYSE KO

- 4. Factors Influencing Coca-Cola’s Stock Price

- 5. Investment Strategies for NYSE KO

- 6. Future Outlook for Coca-Cola Company

- 7. Risks Associated with Investing in NYSE KO

- 8. Conclusion

1. Overview of NYSE KO

The Coca-Cola Company, known by its stock symbol KO, is a multinational corporation that is famous for its carbonated beverages. Founded in 1886, Coca-Cola has become a global leader in the beverage industry, offering a wide variety of products beyond its flagship soda. As of now, Coca-Cola operates in more than 200 countries, serving over 1.9 billion servings of its products every day.

1.1 Company Profile

The Coca-Cola Company is headquartered in Atlanta, Georgia. It has a diverse portfolio of beverages, including soft drinks, juices, teas, coffees, and bottled water. The company's mission is to refresh the world and make a difference in people’s lives.

1.2 NYSE Listing

NYSE KO is listed on the New York Stock Exchange and is considered a blue-chip stock. This status indicates that Coca-Cola is a well-established company with a history of stable earnings and dividends.

2. Historical Performance of Coca-Cola Stock

The historical performance of NYSE KO provides valuable insights into its growth and resilience in the market. Over the years, Coca-Cola has shown a consistent ability to adapt and thrive despite economic fluctuations.

2.1 Stock Price Trends

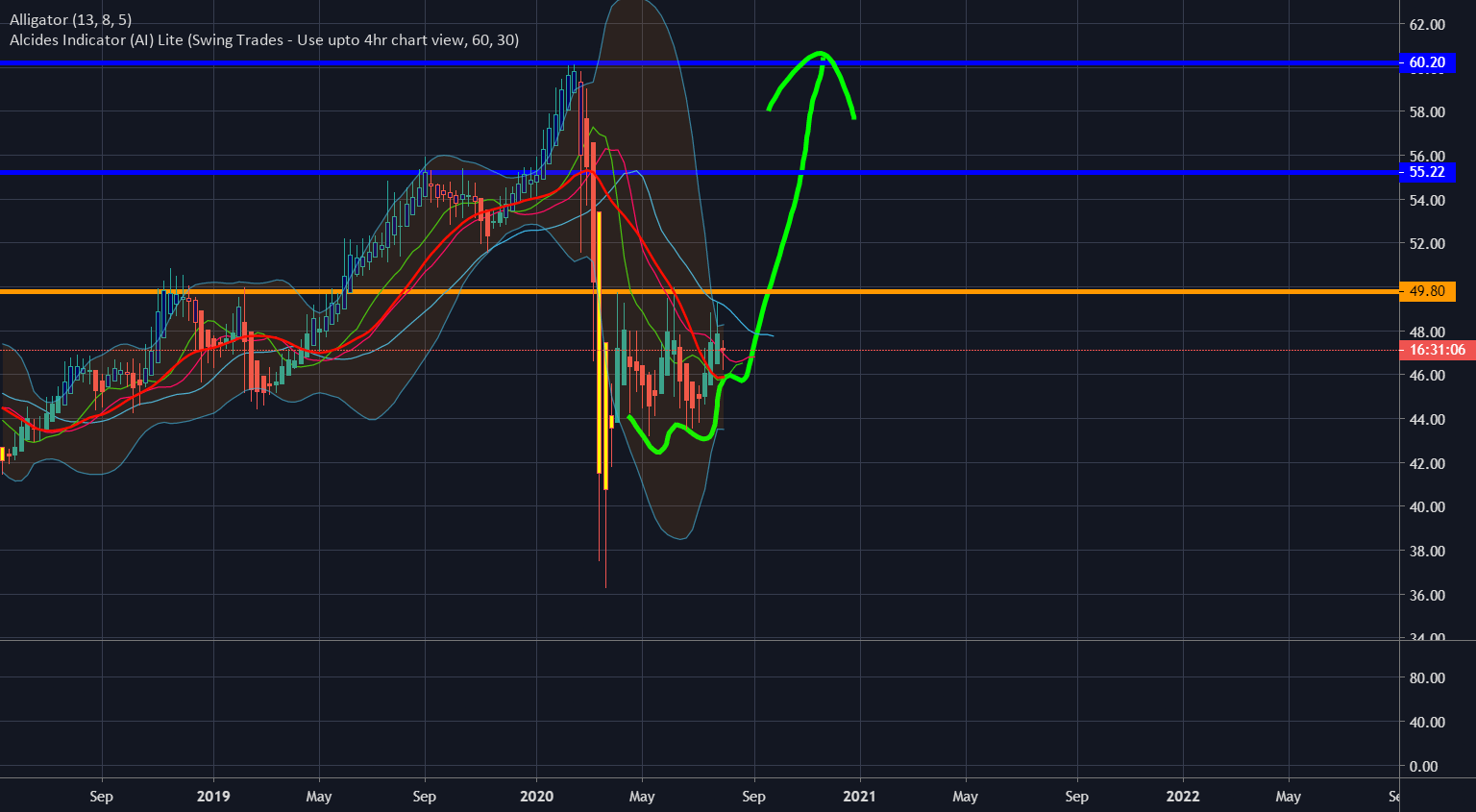

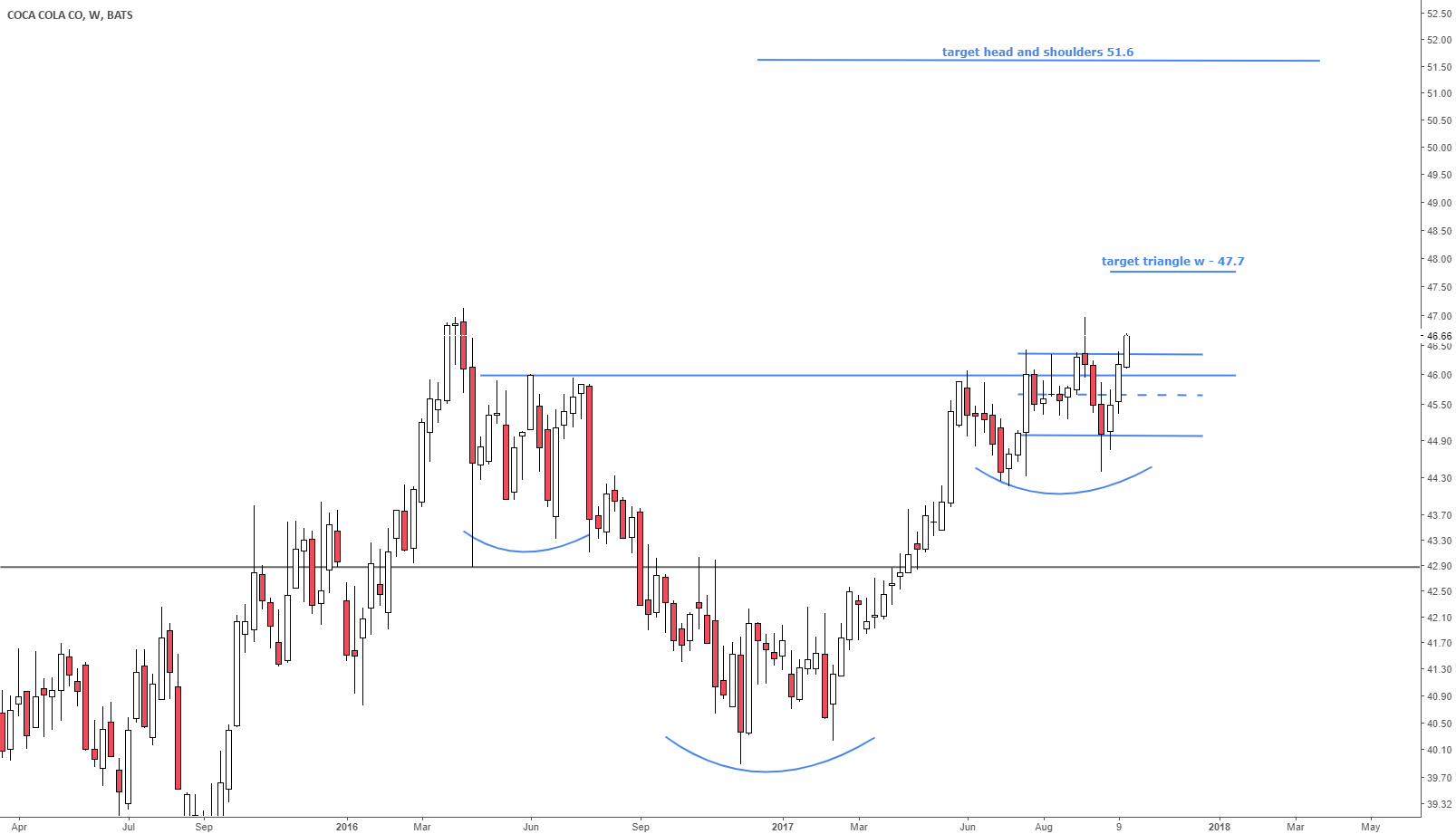

Since its initial public offering (IPO), Coca-Cola’s stock price has seen significant growth. In the 1980s, for instance, the stock was trading at around $2.50 per share, and it has steadily risen to higher levels, currently trading in the range of $60 to $65 per share.

2.2 Dividend History

Coca-Cola is known for its robust dividend history. The company has increased its dividend payout for over 50 consecutive years, making it a reliable choice for income-focused investors. Here are some key points about its dividends:

- Consistent annual dividend increases

- Current dividend yield of approximately 3%

- Shareholder-friendly policies

3. Key Financial Metrics of NYSE KO

Understanding the key financial metrics of NYSE KO is essential for evaluating its performance. Here are some critical indicators:

3.1 Earnings per Share (EPS)

The earnings per share (EPS) is a crucial indicator of a company's profitability. For Coca-Cola, the EPS has shown steady growth, reflecting the company's ability to generate profits.

3.2 Price-to-Earnings (P/E) Ratio

The P/E ratio of Coca-Cola is an important metric for investors looking to assess the valuation of the stock. A typical P/E ratio for KO is around 25, indicating that the stock is relatively valued in comparison to its earnings.

4. Factors Influencing Coca-Cola’s Stock Price

Several factors can influence the stock price of NYSE KO. Understanding these factors can help investors make informed decisions:

4.1 Market Demand for Beverages

The demand for Coca-Cola products directly impacts its revenue and stock price. Changes in consumer preferences toward healthier beverages can affect sales.

4.2 Economic Conditions

Economic downturns can lead to reduced consumer spending, which in turn could impact Coca-Cola’s sales and stock performance. Monitoring economic indicators is vital for investors.

5. Investment Strategies for NYSE KO

Investing in NYSE KO can be approached in several ways, depending on your financial goals and risk tolerance:

5.1 Long-Term Investment

Coca-Cola is often viewed as a safe long-term investment due to its stable dividends and market presence. Investors looking for steady income may consider holding onto this stock for the long haul.

5.2 Growth Investing

For those interested in capital appreciation, investing in Coca-Cola during market dips can provide opportunities for significant growth as the stock rebounds.

6. Future Outlook for Coca-Cola Company

The future outlook for NYSE KO appears positive, but it is essential to consider various elements that could shape the company's trajectory:

6.1 Expansion into New Markets

Coca-Cola is continuously exploring opportunities in emerging markets, which can provide significant growth potential.

6.2 Product Innovation

The company is also focusing on product innovation, particularly in the health beverage segment, to meet changing consumer preferences.

7. Risks Associated with Investing in NYSE KO

While investing in NYSE KO has its benefits, there are also risks that investors should consider:

7.1 Competition

The beverage industry is highly competitive, with numerous players vying for market share. This competition can impact Coca-Cola's pricing strategies and profit margins.

7.2 Regulatory Challenges

Coca-Cola is subject to various regulations that could impact its operations and profitability, especially concerning health and safety standards.

8. Conclusion

In summary, NYSE KO represents a solid investment opportunity for those looking to enter the beverage sector. With a rich history, consistent performance, and a strong brand presence, Coca-Cola continues to be a favorite among investors. As you consider investing in NYSE KO, it is crucial to keep an eye on market trends, economic indicators, and the company's performance metrics.

Feel free to leave a comment below or share this article with fellow investors. Also, check out our other articles for more insights into the stock market!

Thank you for reading, and we hope to see you back on our site for more valuable investment information!

The Dow Industrial Average: Understanding The Heart Of The Stock Market

How To Stream Fox News: A Comprehensive Guide

Understanding Dollaritas: A Comprehensive Guide